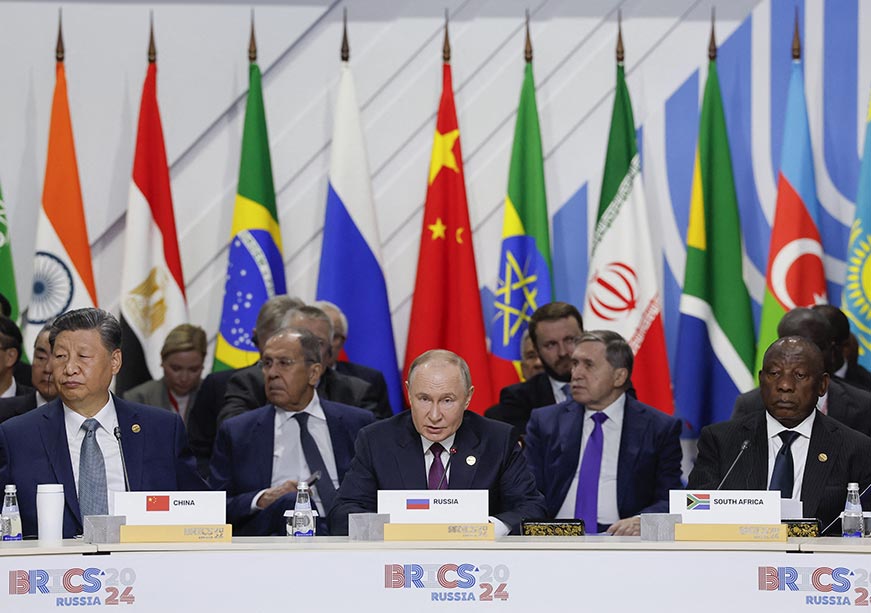

The BRICS bloc, comprising Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Indonesia, Iran, and the United Arab Emirates, is increasingly becoming a point of contention for newly elected US President Donald Trump. The growing alliance, viewed as an alternative to Western-dominated economic structures like the G7, is exploring the use of local currencies for trade among its members, which has sparked strong reactions from Trump.

On his first day in office (January 20), President Trump issued a stark warning to BRICS nations, vowing to impose a 100% tariff on their trade with the United States should they attempt to reduce the dollar’s role in global transactions. Speaking to the press, Trump stated, “As a BRICS nation… they’ll face a 100% tariff if they so much as even think about doing what they thought, and therefore they will give it up immediately.” He added, “If the BRICS nations want to do that, that’s OK, but we’re going to put at least a 100% tariff on the business they do with the United States. It’s not even a threat.”

Trump also reiterated his stance on the matter, claiming, “They (BRICS) tried to do a number on the United States, and if they do that, they are not going to be happy about what’s going to happen to them.” This latest remark builds on a series of previous threats, which saw Trump warn BRICS nations last year against undermining the dominance of the US dollar. He had made it clear that any moves towards de-dollarization would not go unchallenged.

Despite these threats, India has maintained that the economic decisions within BRICS are intended to streamline financial processes among member states and not to target the US. India’s External Affairs Minister, Dr. S. Jaishankar, stated in December 2024 at the Doha Forum that India had “no interest” in weakening the US dollar, seeking to downplay any perceptions that BRICS was acting in opposition to the West.

BRICS’ Vision for Financial Independence

Originally formed in 2009 as ‘BRIC’ (Brazil, Russia, India, and China), the group expanded to include South Africa, Egypt, Ethiopia, Indonesia, Iran, and the UAE. The expansion was driven by a shared interest in diversifying economic engagements and enhancing trade outside the Western-dominated financial system. The group has explored the possibility of using local currencies for trade, which would reduce reliance on the US dollar and better shield member countries from potential sanctions or financial blockades, such as those imposed on Russia and Iran.

The current global landscape, marked by the ongoing Russia-Ukraine war and the post-pandemic fallout, has intensified the need for countries to protect their economies from US sanctions and other geopolitical pressures. Both Russia and Iran, key economic partners for countries like India, have faced significant challenges due to exclusion from the SWIFT financial system, a critical tool for international transactions. As a result, BRICS countries are keen on finding alternative ways to conduct business without being vulnerable to such sanctions.

India’s Balancing Act: Ties with the US and BRICS Allies

India, positioned at the crossroads of balancing ties with the United States while nurturing its longstanding relations with Russia and Iran, finds itself in a delicate situation. India depends on both countries for strategic alliances and critical energy resources. However, the growing influence of China within BRICS complicates matters for New Delhi, given the ongoing tensions between India and China.

India’s stance is clear: it seeks to protect its economic and strategic interests while ensuring that any move towards a local currency or the creation of a BRICS-specific currency does not lead to a dominance of the Chinese yuan on the global stage. New Delhi sees such financial shifts as a means to facilitate smoother transactions and safeguard against economic coercion from external powers.

As BRICS continues to chart its course, the group’s efforts to mitigate the influence of the US dollar may face significant opposition, both from the United States and from within the bloc itself. With the global economy in flux, the coming years will determine how far BRICS can advance its vision of a multipolar financial world, free from the constraints of a dollar-dominated system.