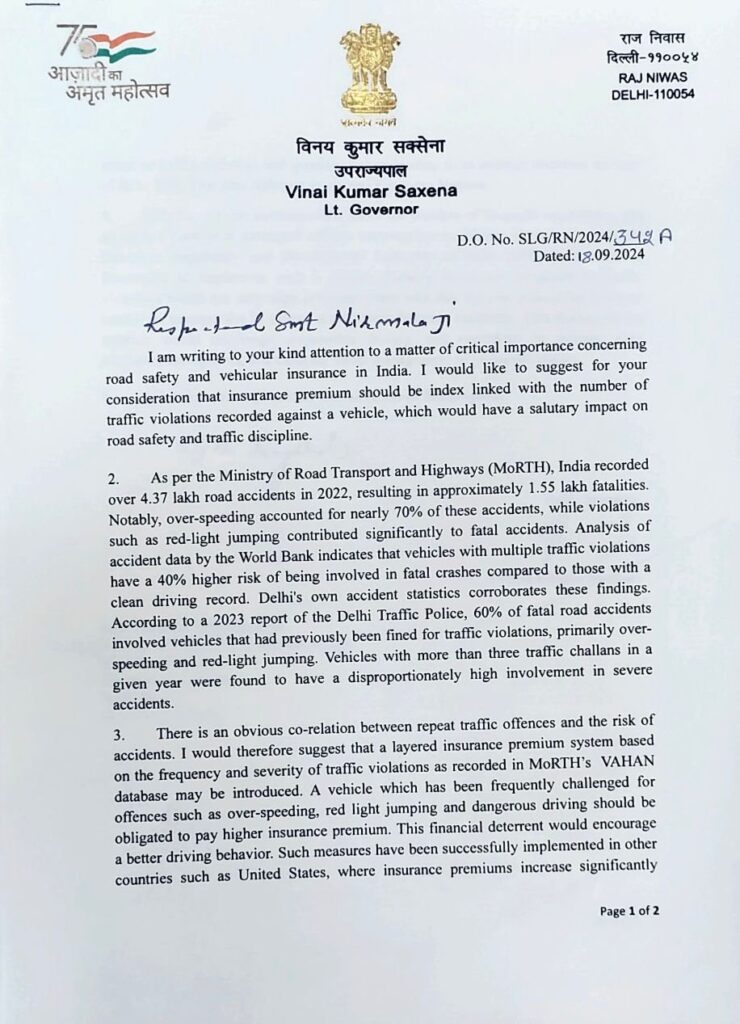

In a recent letter to Union Finance Minister Nirmala Sitharaman, Delhi Lieutenant Governor VK Saxena proposed a groundbreaking initiative to link vehicle insurance premiums to the number of traffic violations recorded against each vehicle. This suggestion aims to enhance road safety and promote responsible driving behavior across India.

Saxena emphasized the urgency of this proposal, highlighting alarming statistics from the Ministry of Road Transport and Highways (MoRTH), which reported over 437,000 road accidents in 2022, resulting in approximately 155,000 fatalities. He pointed out that over-speeding accounted for nearly 70% of these incidents, with violations like red-light jumping also significantly contributing to the high fatality rate.

Research from the World Bank indicates that vehicles with multiple traffic violations have a 40% higher risk of being involved in fatal accidents compared to those with clean records. This trend is reflected in Delhi’s traffic statistics, where a 2023 report from the Delhi Traffic Police revealed that 60% of fatal road accidents involved vehicles that had been fined for violations, primarily for over-speeding and red-light jumping.

Saxena proposed a tiered insurance premium system based on the frequency and severity of traffic violations recorded in the MoRTH’s VAHAN database. He suggested that vehicles frequently cited for offenses such as over-speeding and reckless driving should face higher insurance premiums, serving as a financial deterrent to encourage safer driving habits.

Citing successful implementations of similar systems in countries like the United States, where insurance premiums can increase by 20-30% following traffic violations, Saxena urged the Finance Minister to engage with the Insurance Regulatory and Development Authority of India (IRDAI) to explore the establishment of such a framework in India.

He concluded, “Linking insurance premiums to traffic violations would align insurance costs with actual risk, alleviate financial burdens on insurers from frequent claims, and ultimately foster a culture of responsible driving. This market-driven solution has the potential to significantly reduce road accidents, save lives, and improve overall management of insurance claims.”